For individuals venturing into the world of real estate investment, navigating the landscape can initially appear complex and intimidating. Amidst the myriad of financial metrics and calculations, one term that frequently emerges is “Cap Rate,” short for Capitalization Rate. This metric is crucial for assessing the potential profitability of an investment property. Let’s delve into the intricacies of Cap Rate, shedding light on its significance and how it empowers investors to make informed decisions.

1. Defining Cap Rate

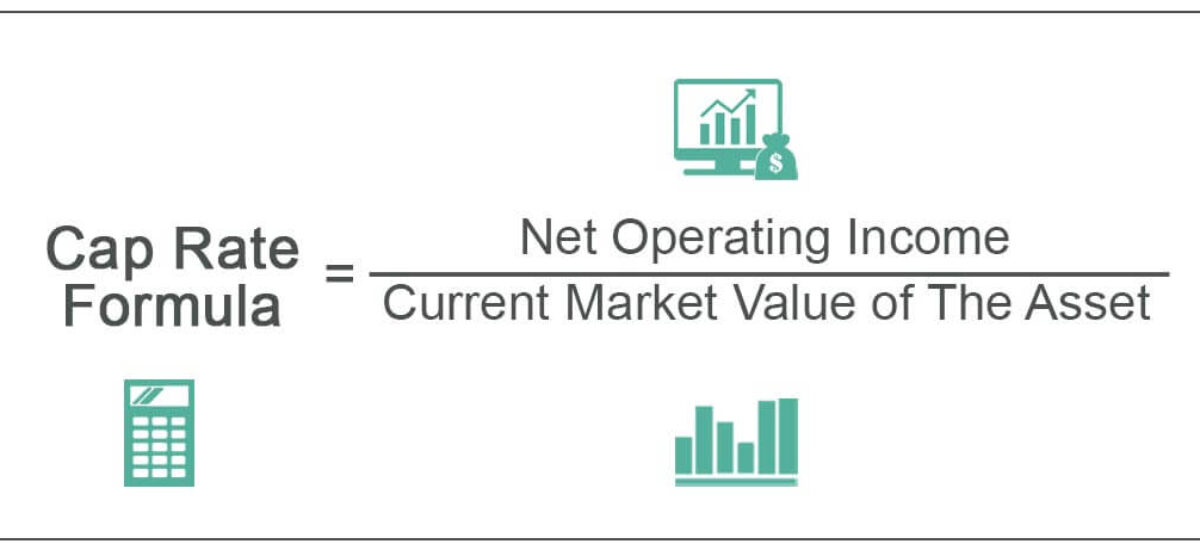

At its core, Cap Rate represents the expected rate of return an investor can anticipate from an income-generating property. It’s expressed as a percentage and is calculated by dividing the property’s net operating income (NOI) by its current market value or acquisition cost.

2. The Formula

Cap Rate can be calculated using a simple formula:

Cap Rate =

Net Operating Income (NOI)

Property’s Market Value or Acquisition Cost

3. Significance of Cap Rate

Cap Rate is an invaluable tool for real estate investors for several reasons:

Quick Assessment: It provides a rapid means of assessing the potential return on investment for a property without delving into intricate financial details.

Comparison Tool: Cap Rate enables investors to compare the profitability of different properties, allowing for informed decision-making in property selection.

Risk Assessment: A higher Cap Rate can indicate a potentially higher return but may also suggest greater risk. Conversely, a lower Cap Rate may signal a more stable, lower-risk investment.

Market Insights: Cap Rates can offer insights into market conditions. Rising Cap Rates may indicate declining property values or increased risk, while falling Cap Rates may suggest a strong market or growing property values.

4. Factors Affecting Cap Rate

Cap Rates are influenced by various factors, including location, property type, market conditions, and investor preferences. Generally, riskier properties or those in less desirable locations tend to have higher Cap Rates to compensate for elevated risk.

In conclusion, Cap Rate is a fundamental metric in real estate investment analysis, offering a snapshot of a property’s potential return on investment. However, it should be used in conjunction with other metrics and thorough due diligence. Cap Rate provides valuable insights into a property’s risk and return profile, empowering investors to assess opportunities and align their investments with their financial goals. As you embark on your real estate investment journey, mastering Cap Rate will be a key step towards informed and profitable decision-making.